Tobacco business

-

Notes 1.

-

The word consumers used in the context of the tobacco business means adult consumers. Minimum legal age for smoking varies in accordance with the legislation in each country

-

2.

-

This section is intended only to explain the business operations of the JT Group, not to promote sales of tobacco or nicotine containing products or encourage smoking or using nicotine containing products

-

3.

-

RRP (Reduced-Risk Products): Products with the potential to reduce the risks associated with smoking

-

Purpose

-

Creating fulfilling moments.

Creating a better future.

The industry can be divided in two product categories: combustible products and RRP (Reduced-Risk Products).

Combustibles

Cigarettes, FCT (fine cut tobacco), pipe, cigars and cigarillos are part of the combustibles category. While cigarettes contain pre-rolled tobacco, FCT products allow adult consumers to roll or make their own cigarettes. The global combustibles industry volume totaled around 5.0 trillion stick equivalent units in 2023, representing a value of approximately 101 trillion yen. The largest markets are China—which accounts for over 45% of global volume—followed by Indonesia, Russia, the U.S., Turkey, Germany, Japan and Vietnam. While the global combustibles industry volume is declining, the industry value continues to increase driven by a positive pricing contribution.

RRP

Heated tobacco, E-Vapor and oral products are part of the RRP category. As they deliver nicotine without combustion, they have the potential to reduce risks associated with smoking.

HTP (heated tobacco products) include HTS (heated tobacco sticks), which generate an aerosol containing nicotine by heating a tobacco stick, and Infused (infused tobacco capsules), a hybrid system which creates a tobacco-enriched vapor using indirect heating of a tobacco capsule.

E-Vapor products heat a nicotine-containing liquid instead of tobacco leaves and come in different formats: open tanks, closed pods and disposables. Oral products are usually in the form of small pouches to be inserted in the mouth between the lip and the gum. If they contain tobacco they are referred as snus, if they don’t as nicotine pouches.

The global RRP industry had an estimated value of approximately 11 trillion yen in 2023. The largest markets are Japan for HTP and the U.S. for E-Vapor and oral products. Unlike combustibles, the most successful RRP varies from one market to another depending on consumer preferences. The overall RRP category, though smaller than combustibles, has been growing steadily over the last years, and we expect this growth to continue, notably in HTS.

Our view of the future

Over the last years, the main international tobacco players expanded their portfolio in both combustibles and RRP to offer more choice to consumers. The JT Group’s tobacco business is ranked third in the world (excluding China) by volume and has a product offering across all combustibles and RRP segments.

We expect the global combustibles industry value to continue growing in the foreseeable future, while the global RRP industry is expected to grow both in terms of volume and value. Among RRP segments, we expect HTS to be the largest growth driver, followed by E-Vapor and nicotine pouches. The growth rate will ultimately depend on innovation, consumer acceptance, regulation and taxation of RRP products.

SWOT analysis

-

STRENGTHS

-

Strengths

- Consumer at the center of all that we do

- Powerful and inspiring brands

- Diverse and motivated workforce

- Accelerating RRP investments

-

Weaknesses

-

Weaknesses

- Limited geographical RRP presence

- New capabilities still in the making

-

Opportunities

-

Opportunities

- Tobacco pricing model still intact enabling us to maximize value creation from combustibles

- Grow exposure in HTS segment

- RRP category far from mature

-

Threats

-

Threats

- Tightening regulatory environment

- Changing consumer preferences

Performance over the last five years

The tobacco business outperformed the industry volume over the last five years through continued market share gains driven by our GFB (Global Flagship Brands; Winston, Camel, Mevius and LD), Ploom X and acquisitions in tobacco markets that matter.

GFB volume grew constantly, reaching almost 390 billion units and more than 70% of our total volume in 2023. For the first time, Winston and Camel crossed the 200 and 100 billion units mark, respectively. The achievement of these remarkable milestones was fueled by our excellence in execution and by decades of sustained investments behind our GFB.

Since its launch in 2021, Ploom X recorded continued share of segment gains in Japan and significant traction among consumers, both in terms of acquisition and retention rates. By the end of 2023, Ploom X was rolled out in 12 markets outside Japan with encouraging results.

GFB and Ploom X volume growth, together with acquisitions, solid pricing and cost discipline, enabled the tobacco business to consistently grow core revenue and adjusted operating profit at constant currency over the last five years.

-

Combustibles

-

HTS

-

Other RRP

-

*1

-

Based on internal estimates excluding China

-

*2

-

The year-on-year variances from 2019 to 2020 of core revenue and adjusted operating profit are calculated based on the sum of the Japanese domestic and international tobacco businesses. From 2022, we consolidated the tobacco business, and 2021 figures are adjusted as well

Our Purpose

Our Purpose—Creating fulfilling moments. Creating a better future—defines why we exist as a business and how we contribute to the broader JT Group Purpose. It is also a statement to wider society of our intent and the North Star guiding our tobacco business strategy.

Our strategy

To create fulfilling moments and a better future, we have articulated a clear strategy for the tobacco business, prioritizing management resources towards HTS, the main RRP growth driver, and combustibles, the largest, most profitable category across the tobacco industry. This is in line with our view of the industry presented at the Tobacco Investor Conference in May 2023.

The combination of the Group’s tobacco businesses into a single business segment, which was completed in January 2024, is supporting this prioritization of resources, globalizing the Group’s knowledge and expertise, driving increased agility, and accelerating strategic decision-making.

This strategy, moreover, confirms the tobacco business as the profit engine of the Group and strengthens its role as the main source of profit growth for the medium- and long-term.

RRP

The RRP category is still to mature, with each product segment being in different stages of development as consumer acceptance varies from one market to another.

We expect HTS will offer the strongest growth profile among existing product segments in RRP. In this context, the Group is prioritizing investments towards HTS and accelerating efforts to increase share of segment.

To more than double our RRP core revenue by 2026*1, we will accelerate strategic investment in RRP, notably HTS. We expect to exceed the 300 billion yen investment which was originally planned from 2023 to 2025. Another investment area will address R&D efforts towards next-generation products (NGP), as we think the RRP category will continue to expand beyond the current product lineups.

In 2021, the Group launched its latest heated tobacco device—Ploom X—in Japan, followed by the U.K. in 2022 and 11 additional markets in 2023. Since Q1 2021, our share of HTS segment more than tripled in Japan, renewing our confidence in our ability to offer superior-quality products in this growing segment. The Group is planning to roll out Ploom X and its dedicated consumables in more than 40 markets by 2026, with the ambition to reach a mid-teens share of the HTS segment in key markets by 2028.

This effort will be complemented by focused investments in other product segments, as one single solution doesn’t translate into sustainable success in RRP. These additional segments, such as Infused, E-Vapor and oral, are considered exploratory opportunities. The Group aims to gain a better understanding of the dynamics in each of these segments and collect relevant consumer insights ahead of future growth. In the HTS and exploratory RRP segments combined, our ambition is to reach break-even by 2028*2, driven by top-line growth and enhanced productivity.

-

*1

-

Compared to 2023

-

*2

-

Breakeven at brand contribution level representing gross profit less commercial expenditure and before allocation of overheads

Combustibles

We recognize the combustibles industry volume will continue to decline. However, combustibles users will remain the largest cohort of consumers within the industry for at least another decade.

The JT Group intends to continue satisfying the needs of these consumers, by exceeding their expectations. To do so, resources will be allocated in priority towards our GFB—which have strong brand equity and high profitability—with the intent of maximizing returns and supporting the investments in RRP.

Consistently investing in the strengthening of the equity of Winston, Camel, MEVIUS and LD is key to sustain the Group’s market share gains in the combustibles category and leverage pricing opportunities. In addition, we assigned each market to a strategic role (Earnings / Earnings & Share / Share) to enhance focus and guide decision-making.

Strengthening competitiveness

As part of the Group’s continuous improvement efforts, we constantly review our global supply chain and our market operating models for efficiencies and better effectiveness.

Within the global supply chain, we explore opportunities to rationalize our manufacturing footprint and our leaf-sourcing channels, as well as logistical routes, closer collaboration with suppliers, and portfolio simplification.

In market-operating models, we optimize notably route-to-market and route-to-consumers in order to ensure we can respond quickly and with agility to changing customer expectations.

We also consider corporate initiatives like the simplification of internal structures, the migration of legacy IT systems to global solutions and the empowerment of Global Business Service centers to better support markets. The aim is to continuously improve margins, while maintaining quality, and to enhance cash flow generation by optimizing working capital and capital expenditures.

We believe that human resource development is key to strengthening competitiveness. With business operations in at least 70 markets and sales in more than 130 markets, our global employee workforce is very diverse, including over 110 nationalities.

The quality of human resources is key to business activity and performance, and this is the reason driving the efforts of the Group to strengthen human resource development and enhance its ability to attract, develop, and retain employees on a global basis.

Sustainability priority

In 2023, we launched a new Sustainability Impact Framework. The framework is built on a double materiality approach and defines JTI’s sustainability priorities.

The framework helps ensure we focus on the areas where, through our products or operations, we can have the most impact.

- The full framework can be seen on Sustainability strategy

Increasing HTS consumer base in our Ploom X franchise

Ploom X share gains in Japan

Ploom X recorded continued share gains within an increasingly competitive HTS segment in Japan, reaching an exit share of 11.0% in Q1 2024.

Consumers recognize the quality of our device, the superior taste and the strong brand equity of our heated tobacco sticks Camel and MEVIUS—which are the first and second combustible brands in Japan.

In March last year, relaunched MEVIUS heated tobacco sticks with an improved taste at a more affordable price, allowing consumers to choose from a broader variety of flavors and to better personalize their Ploom experience.

Our commercial engine includes both physical and digital channels to increase Ploom accessibility and visibility. We constantly invest in research and development to enhance our product’s technology and address consumer feedback.

To give an example, our new Ploom X ADVANCED launched in November 2023 delivers improved taste with a higher heating temperature and features a reduced charging time, as well as an automatic heating function. All features that improve the consumer experience.

As a result of our various initiatives, the Ploom solus ratio, that is the percentage of Ploom users getting 100% of their tobacco consumption with Ploom over the last month, increased significantly over the last two years—a meaningful achievement.

Ploom quarterly SoS in HTS in Japan*

*

Ploom shipment volume / HTS industry shipment volume

Encouraging results from Ploom X geo-expansion

2023 was the first of a multi-year geographic expansion plan for Ploom X. As we had to build inventories of devices following the global micro-chip shortage, this expansion was skewed to the second half of 2023.

As result of the ongoing expansion plan, Ploom X is sold in 15 markets outside Japan as of the end of April 2024: the U.K., Italy, Lithuania, Portugal, the Czech Republic, Switzerland, Poland, Hungary, Romania, Greece, Kazakhstan, Slovenia, Slovakia, Spain, the Canary and, Islands.

Ploom X market share is growing steadily, including in newly launched markets. In Italy, we have strengthened our distribution and expanded nationwide since last November. Post the nationwide-expansion, our segment share has been growing steadily, reaching 1.5% as of March 2024. In the Czech Republic and Switzerland, where we launched in June and September 2023, respectively, our segment share has constantly increasing since the launch, with segment share of 4.6% and 1.8% as of March 2024. Our launch strategy in HTS focuses initially on large urban cities. This means that our segment share performance tends to be higher in these cities. For instance, in Geneva, our segment share reached 4.1% in March. In the UK, we were humbled to hear that Ploom was recognized with the prestigious Product of the Year award.

We expect Ploom X’s footprint to reach 28 markets by the end of 2024 and 40+ markets by the end of 2026, covering approximately 80% of the global HTS category volume.

Number of Ploom X markets

Maximize top-line and ROI

Continued strong pricing in combustibles

2023 marked another record year with 144 billion yen of favorable price/mix variance to core revenue. This performance demonstrates once again the resilience of pricing in combustibles and enabled us to more than compensate for the cost increases due to the macroeconomic and geopolitical environments.

Focusing on pricing more specifically, key markets like the Philippines, Romania, Russia, Spain and the U.K. supported our top-line expansion along with many others, notably Canada, France, Germany, Indonesia, Kazakhstan and Poland.

Looking ahead, we remain confident in the sustainability of the combustibles pricing model across our clusters.

RRP sourcing

We have a dedicated RRP sourcing team specialized in sourcing RRP devices. These are manufactured by third-party contract manufacturing organizations. Subject to strict technological and quality requirements, we engage with our suppliers to address sustainability risks inherent to the electronics industry.

We are a member of RBA, the world’s largest industry coalition dedicated to corporate social responsibility. We commit to the RBA Code of Conduct and leverage the available tools to ensure responsible manufacturing of our products. All our Tier 1 suppliers have undergone independent third-party audits as part of the RBA Validated Assessment Program.

We seek to ensure the metals contained in our products are responsibly sourced. We take a risk-based approach and conduct due diligence in line with OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas. We leverage the tools offered by the Responsible Minerals Initiative (RMI) to increase visibility further down our supply chain.

We take a collaborative approach and support and build supplier capability to address identified sustainability issues in our value chain.

- Read more on responsible procurement.

Our Purpose—Creating fulfilling moments. Creating a better future—is the basis of everything we do.

In 2023, we developed a new Sustainability Impact Framework (see below). The framework has established three main areas (or pillars) for us to focus on going forward. These include innovating products (product impact), empowering people, and protecting the planet (operational impact). These focus areas were developed following a thorough materiality review that was conducted in 2022 by the tobacco business.

New targets and KPIs have been established in 2023 for each impact area of the framework.

Innovating PRODUCT

Reducing health impact

Reducing health impact

Reducing the health impact of our products is of notable importance, which is why reduced risk products (RRP) form an important part of our offering and are a competitive driver for our business.

While it is still too early to understand the long-term health effects of RRP, factors including the elimination of combustion and fewer toxicants found in the vapor, suggest there is potential for them to reduce the risks associated with smoking.

That’s why we’re committed to ensuring all our RRP fulfill this potential, also offering consumers greater choice in this fast-moving category. We pride ourselves on an open approach that embraces scrutiny from consumers, regulators and the scientific community, and we regularly present our findings at scientific conferences and in peer-reviewed journals.

Providing our customers with more access to RRP is therefore the central component of our strategy in this area. It has been contributing to our commercial growth as evidenced by our performance in 2023 (see RRP earlier in this section for more details).

However, minors should not use or have access to tobacco or other nicotine-containing products. This belief is central to JT’s Tobacco Business Code of Conduct and its marketing practices, operational policies and way we do business. JT’s tobacco business is committed to playing its full part in youth access prevention, ultimately success depends on all elements of society working together.

- Read more about the science behind RRP at www.jt-science.com

Designing for circularity

Designing for circularity

We have developed a circularity framework to illustrate how our Global Circular Economy ambition translates into reality.

The conventional model of “take-make-waste” is antithetical to sustainability and we must therefore transition to a more circular economy moving forward. It requires a complete rethink of the way we produce and use resources and the practical steps we can take to extend the life of our products.

We introduced new circularity targets regarding both products and packaging, including RRP devices. We are committed to embedding key circular development principles and communicating responsively; engaging with suppliers to support circularity principles and ensure the availability of circular materials at scale; actioning the comprehensive circularity implementation plan we’ve developed to guide all our business functions, regions, and markets so they can deliver on targets; monitoring, analyzing, anticipating, and responding to a constantly evolving circularity landscape to ensure we’re making the best choices for our products both now and in the future.

Moving forward, we have a number of ongoing key initiatives with ambitious deliverables that will continue to improve our product circularity, including allocating necessary resources such as R&D to sustainable packaging and sustainable filter alternatives.

While we ultimately seek to replace polypropylene (plastic) with non-plastic alternatives, in 2023 we began using recycled content in our polypropylene wraps. In 2023, we also continued replacing aluminum inner liner with a paper one and working on rolling it out more widely. This initiative has no impact on product quality, improves recyclability and reduces emissions footprint.

In 2023, 88% of our packaging (including plastic) was reusable or recyclable. This puts us on track to achieve our target of 100% recyclability by 2030. Additionally, 19% of our packaging was made from recycled content, which will assist us in achieving our target of 20% by 2025.

To encourage consumers to safely recycle or dispose our products, we inform them on how to dispose their old products in a responsible and sustainable manner. In our Ploom markets, consumers have access to responsible disposal of electronic devices.

In Japan, we launched a program in 2019 to collect used Ploom devices, capsules and cartridges via convenient collection boxes at around 300 shops in Tokyo. In 2020, this program was extended to include additional tobacco players and it was launched throughout Japan in 2021. Since then, around 1,200 collection points have been established in all 47 prefectures.

Read more about improvements of our packaging and about our approach to circularity, post-consumer waste management and anti-littering on our website.

-

-

Rethink :

Reduce the materials used in our production process and substitute finite and virgin materials with recycled or regenerative materials.

-

Extend :

Improve the average lifetime and utilization rate of our products (devices) by building them with durability in mind and implementing interventions such as battery removability and replaceability.

-

Recover :

Contribute to recovery of components or materials where possible via enabling recycled content integration in our packaging and establishing take back for recycling schemes.

-

Designing for circularity:

VIRGIN PLASTIC will be further reduced in our packaging

100%

of our packaging will be recyclable by 2030

20%

recycled content in our packaging by 2025

We are working to develop more SUSTAINABLE FILTER alternatives

100%

of our RRP devices shipped to the EU by 2027 will have removable and replaceable battery

All tobacco business targets can be found on jti.metrio.net

Empowering PEOPLE

Attracting talent and fostering an inclusive employee experience

Attracting talent and fostering an inclusive employee experience

In 2023, we retained our Global Top Employer status (as certified by the Top Employers Institute) for the 10th consecutive year.

We believe that employee engagement leads to long-term employee retention, higher levels of productivity, and improved quality of work. Our aspiration is that every person that works in JT’s tobacco business feels they belong.

Thus, we constantly invest in our employees at all levels to ensure they flourish. Our commitment to talent development and retention is reflected by the fact that over 90% of our management positions are staffed internally. In 2023, we have achieved 30% of women in leadership positions, and we are broadening this scope through our newly updated commitment to achieve and maintain at least 1/3 of women in management by 2030.

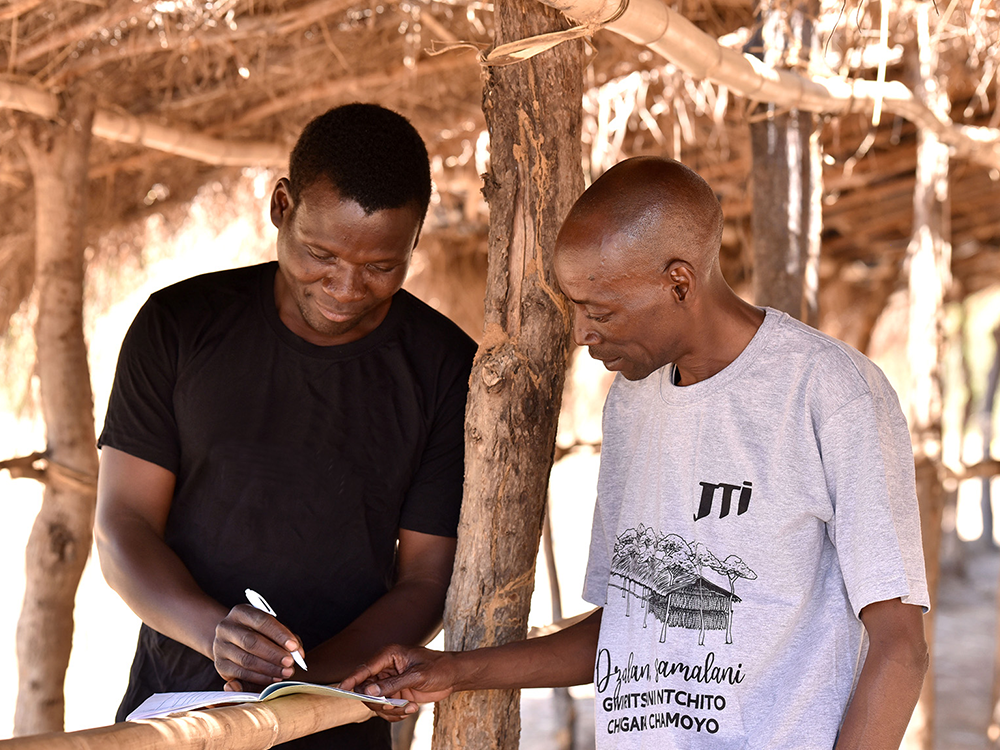

Improving grower livelihoods

Improving grower livelihoods

Our Agricultural Labor Practices (ALP) program has been expanded in scope to become more holistic and it now forms part of our supply chain due diligence (SCDD) in farming communities.

The SCDD process follows the Guidance for Responsible Agricultural Supply Chains provided by the Organization for Economic Co-operation and Development (OECD) and the Food and Agriculture Organization, as well as recommendations by the International Labour Organization. It also follows the United Nations Guiding Principles on Business and Human Rights.

We are dedicating efforts to enhance the livelihoods of growers in countries facing challenges, and we have established new targets to achieve this goal. In 2023, we worked with 65,315 directly contracted growers, helping them to improve their productivity and leaf quality.

We also support communities in other ways. For example, our flagship ARISE (Achieving Reduction of Child Labor in Support of Education) program has been committed to tackling child labor in our tobacco-growing communities since 2011. ARISE is part of our Child Labor Elimination Framework. To date, 66,825 at-risk children have been withdrawn or prevented from child labor and enrolled in education through the program and 26,998 households have benefitted from socio-economic empowerment projects and improved incomes.

Improving grower livelihoods:

100%

Of our direct tobacco leaf supply chain origins will implement our Living Income Calculator by 2025

100%

Of farms in our direct tobacco leaf supply chain origins will be monitored for human rights, including child labor by 2025

100%

Of growers and farmworkers in our direct tobacco leaf supply chain origins will get access to remedy via grievance mechanisms by 2027

All tobacco business targets can be found on jti.metro.net.

Protecting PLANET

Tackling climate change and reducing emissions

Tackling climate change and reducing emissions

We are a global company and climate change represents a real threat to the future of our business.

We are aiming to be carbon neutral in our own operations by 2030 and to achieve Net-Zero Greenhouse Gas (GHG) emissions across our entire value chain by 2050.

Since 2019, when we established our baseline, we have reduced emissions from our own operations by 19%, keeping us on track to reach our 2030 target of 47%. However, emissions associated with our leaf and non-tobacco materials have increased slightly by 3%, which we will address moving forward.

In 2023, we accelerated the operationalization of our Net-Zero strategy through workstreams dedicated to energy efficiency and procurement, green mobility, supplier engagement and sustainable business travel.

Additionally, in 2023, we established a green loan facility to support investment in projects that will help us deliver on our Net-Zero commitment. External verification of our use of the funds will be undertaken on an annual basis. The projects will have a timespan of three to five years and will be spread across our operations around the world. They will include initiatives in energy efficiency, renewable energy, power purchase agreements and nature-related agronomy programs.

Tackling climate change:

-

Carbon neutral

In our own operations by 2030Net-Zero GHG emissions

Across our entire value chain by 205047%

Emissions reduction from our operations by 2030 (against a 2019 baseline)28%

Emissions reduction from our leaf and non-tobacco materials by 2030 (against a 2019 baseline) -

Conserving nature

Conserving nature

With this important topic, we focus our efforts on four areas: protecting water, reducing operational waste, enhancing biodiversity and promoting sustainable agriculture.

In both water stewardship and waste management, we have achieved our 2030 targets seven years early. We have reduced our water withdrawal by 29% in relation to our own operations (against a target of 15%) and cut operational waste by 20% (against a target of 20%)*. Consequently, new more ambitious targets have now been introduced.

In terms of sustainable farming, we committed to eliminate Highly Hazardous Pesticides (HHPs) from our supply chain. We train our growers on proper handling of Crop Protection Agents (CPAs) to protect people, animals and the environment. We also raise awareness among our suppliers about the importance of using less hazardous CPAs.

An example of our activities in action was in Bangladesh, a country that faced a dire water crisis that challenged communities and ecosystems. It was notably exacerbated by industrial pollution. Our local team introduced a new solar-powered, chemical-free wastewater treatment plant. They then shared their knowledge and learnings with neighboring industrial facilities, helping others to adopt the approach.

More detailed information on our sustainability strategy, targets and performance is available on jti.metrio.net.

*

Baseline year 2015

Conserving nature:

33%

Water withdrawal reduction by 2030 (against a 2019 baseline)

Zero

Factory waste to landfills by 2030

100%

All wood used in the tobacco curing process by directly contracted growers will be replaced with renewable fuel sources by 2030

All tobacco business targets can be found on jti.metro.net.